Crypto FAQ: What is cryptoeconomics? What is DeFi?

This Cryptoeconomics FAQ consists of Frequently Asked Questions related to cryptoeconomics, Decentralized Finance (DeFi), and related topics.

For a general overview of cryptoeconomics and the practical application of DeFi techniques to financial applications, see the following FAQs:

- Alt. Phrasing: What is a digital economy?; What is a cryptoeconomy?; What is Decentralized Finance (DeFi)?

Defn: cryptoeconomics

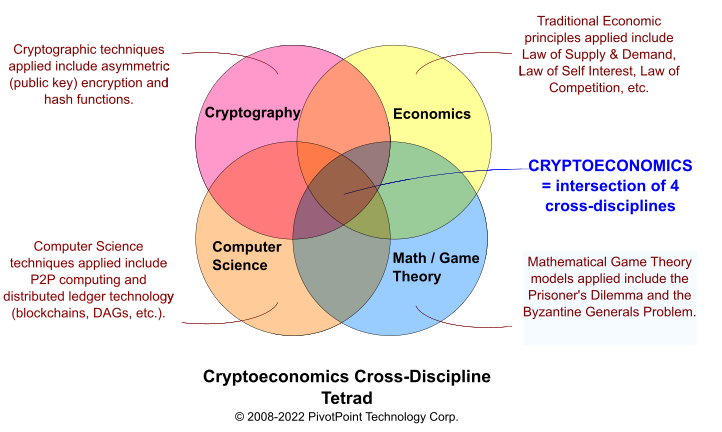

[noun: portmanteau of "cryptocurrency" + "economy"]Cryptoeconomics *is a cross-disciplinary approach to the study of digital economies and decentralized finance (DeFi) applications. In addition to traditional economic concepts and principles (production, distribution, and consumption of goods and services) cryptoeconomics synergistically integrates concepts and principles from cryptography, computer science, and mathematical game theory disciplines.

Stated succinctly as an analogy:

cryptoeconomics : Decentralized Finance (DeFi) :: [traditional] economics : Centralized Finance (CeFi)

Goals: see FAQ: What are the goals of cryptoeconomics?

- Contributions from Cross-disciplines: Selected major contributions from the four cross-disciplines of cryptoeconomics are listed below:

- Economics

- Law of Supply & Demand

- Law of Self Interest

- Law of Competition

- Fiat Money Theory

- Modern Monetary Theory (MMT)

- Cryptography

- cryptographic keys

- hash functions

- asymmetric (public key) encryption

- Multi-Factor Authentication (MFA)

- End-to-End Encryption (E2EE)

- Zero Knowledge Proofs (ZKP)

- Computer Science

- peer-to-peer (P2P) network architectures

- Distributed Ledger Technology (DLT)

- DLT data structures, blockchains, Directed Acyclic Graphs, Merkel Trees

- single (central) point of failure

- Byzantine Fault Tolerance (BFT)

- consensus algorithms

- digital signatures

- Mathematical Game Theory

- Nash equilibrium

- Byzantine Generals Problem

- Prisoner's Dilemma

- Markov Decision Process

- Schelling game

- P + epsilon Attack

- Economics

* How It works: see How [Cryptoeconomics] Works section of this web

Example Applications:

Various examples exist of the practical adoption of cryptoeconomic and DeFi principles, with mixed results. On one hand, the potential adoption of blockchain-based ID (identification) through Cardano in Ethiopa could radically accelerate the country's economic development, though the project faces backlash for its "crypto-colonial" nature. Less successful were attempts in El Salvado and Puerto Rico: the former has remained vastly in debt despite efforts to use Bitcoin to circumvent this, while the latter's attempt to use cryptocurrencies to reverse the damages of Hurricane Maria ultimately proved to be futile. This being said, the potential of DeFi platforms to promote greater financial inclusion within developing nations, thereby helping to decrease poverty in these nations, cannot be ignored.- References:

- Brekke, Jaya Klara and Wassim Zuhair Alsindi. Cryptoeconomics, Internet Policy Review 10.2, 2021.

- Chris Berg, Sinclair Davidson, Jason Potts. Understanding the Blockchain Economy: An Introduction to Institutional Cryptoeconomics. Edward Elgar Publishing, 2019.

- Jian Gong, Wei Xu. Cryptoeconomics: Igniting a New Era of Blockchain. CRC Press, 2020.

- Ziyao Liu, et al. A Survey on Applications of Game Theory in Blockchain. IEEE, 2019.

- Vitalik Buterin. The P + epsilon Attack. Ethereum Foundation Blog, 2015.

- Brekke, Jaya Klara and Wassim Zuhair Alsindi. Cryptoeconomics, Internet Policy Review 10.2, 2021.

- See also:

The goals of cryptoeconomic systems include the following:

Funding DeFi systems via cryptocurrencies, tokens, and other digital assets;

Designing DeFi systems' that are reliable (fault tolerant) and cybersecure, using proven techniques and best practices of cryptography and computer science;

Developing and implementing Defi systems that are based on sound designs* (see above), such as Decentralized Autonomous Organizations (DAO) and Decentralized Exchanges (DEX);

Facilitating the operations of DeFi systems by applying rigorous software maintenance techniques and best practices; and

Applying economic incentives and penalties to regulate the distribution of goods and services in emerging digital economies.

- See also:

- FAQ: What is cryptoeconomics and how does it work?

- How Cryptoeconomics Works section of this web

- Alt. Phrasing: What is Decentralized Finance (DeFi)?; What is Centralized Finance (CeFi)? How do DeFi and CeFi compare?*

Defn: Decentralized Finance (DeFi)

[compound noun: "decentralized" + "finance"]

Decentralized Finance (DeFi) refers to a financial system that is not built on a centralized institution but on blockchains and/or smart contracts, which provide software programs with instructions on what to do under certain circumstances. As DeFi systems are built on smart contracts, the transaction processing that is traditionally done by different parties is instead done with code. Therefore, transactions should, if done correctly, be processed without involving any intermediaries (e.g. banks), and can be done without needing to make an account.Defn: Centralized Finance (CeFi)

[compound noun: "centralized" + "finance"]

Centralized Finance (CeFi) refers to a financial system that is built on a centralized institution, such as the Federal Reserve. CeFi is generally more secure than DeFi, since it is not anonymous and is processed by multiple different actors, but is therefore slower than DeFi. Additionally, funds are managed and controlled by the centralized institution the system was built around, meaning users do not have direct control over their money.

- Alt. Phrasing: What is crypto-macroeconomics?; What is crypto-microeconomics? What is macro-cryptoeconomics?; What is micro-cryptoeconomics?; How do crypto-macroeconomics and crypto-microeconomics compare?

In a manner similar to how traditional economics is divided into macroeconomics (regional, national, and international economics) and microeconomics (individual and enterprise economics) subdisciplines, cryptoeconomics can be divided into crypto-macreconomic and crypto-microeconomic subdisciplines as defined below:

Defn: crypto-macroeconomics (DeFi)

[compound noun: "cryptocurrency" + "macro" + "economics"]

Crypto-macroeconomics is concerned with the regional, national and international regulation of cryptocurrencies and DeFi transactions.Defn: crypto-microeconomics (DeFi)

[compound noun: "cryptocurrency" + "micro" + "economics"]

Crypto-microeconomics is concerned with the individual and enterprise (business, corporate) usages of cryptocurrencies and DeFi transactions.

Cryptocurrency is a decentralized form of digital currency that uses strong cryptography techniques (e.g., blockchains with cryptographic hash functions) and distributed peer-to-peer networks to securely regulate currency generation and fund transfers independent of central banks.

For a more comprehensive explanation of cryptocurrency see the source FAQ: What is cryptocurrency and how does it work? on fhe CryptoCurrencyWorks.com web.

- Alt. Phrasing: What is a blockchain smart contract?; What is a digital contract?

Defn: smart contract

[compound noun: adjective "smart" (automatic execution of) + noun (financial) "contract"]A smart contract refers to a computer algorithm program (software code) hosted on a cryptocurrency blockchain (Digital Ledger Technology [DLT]) that executes (enforces) the legal terms of a financial agreement between two or more parties. A smart contract typically uses the cryptocurrency associated with its host blockchain to legally bind and enforce the subject financial agreement. Smart contracts allow cryptocurrency software developers to build applications that take advantage of blockchain accessibility, reliability, and security to automatically execute a wide range of financial applications, ranging from currency trading and loans, to insurance and gaming.

Smart contracts may be considered a type of financial account on a blockchain, which typically means that they have an account balance in the blockchain's native cryptocurrency, and they initiate cryptocurrency credit/debit transactions across the blockchain network. Smart contracts typically define rules, like a regular financial contract, and automatically enforce them via the smart contract computer program code. Smart contracts cannot be deleted by default, and their financial transactions (e.g., credits/debits) are generally irreversible.

The introduction of smart contracts differentiates first generation blockchains and cryptocurrencies blockchains (e.g. Bitcoin/BTC) from second generation cryptocurrency blockchains (Ethereum/ETC). Indeed, in 2015 the Ethereum/ETH project, led by Vitalik Buterin, pioneered the innovative integration of smart contracts into blockchains, which serves as the foundation for a wide range of Decentralized Finance (DeFi) applications.

Computer Science Perspective

From a computer science perspective, the inclusion of smart contracts into blockchains makes them Turing complete and consequently capable of executing any financial algoirthm relevant to a financial contract application. For example, an Ethereum smart contract is simply a computer program (software code) that runs on the Ethereum blockchain. More specifically, its a collection of software code (its "functions") and data (its "state") that resides at a specific IP (Internet Protocol) address on the Ethereum blockchain that conditionally executes when relevant events occur (receipt of payment, escrow terms are satisfied for both parties, etc.).

Digital Economic (Cryptoeconomic) Perspective

From a digital economic perspective, the inclusion of smart contracts into blockchains enables them to support a wide range of Decentralized Finance (DeFi) applications that include, but are not limited to, currency exchange, saving with interest, lending, trading, escrow, insurance, gambling, gaming, etc.

Compare: Distributed Ledger Technology (DLT) law

Contrast: (traditional legal/financial) contract

Reference(s):

* smart contract [Wikipedia]

* An Introduction to Smart Contracts and Their Potential and Inherent Limitations, Harvard Law [Stuart 2018]

- Defn: tokenomics

[portmanteau: noun "token" + noun "economics"]

Tokenomics refers to the study of the economic properties of a particular cryptocurrency coin or token. These properties—including its distribution, supply, market capitalization, and token model—are generally discussed in the token project's whitepaper, and can be used to determine the value and potential future value of a particular token. The main aspects of tokenomics are further explained below:

Distribution - cryptocurrency tokens can be generated through either pre-mining or a fair launch. If tokens are pre-mined, this means that some tokens are distributed to an exclusive group (e.g. early investors and project members) before the token project is publicly launched. In contrast, a fair launch means that no early access to a token is given before it goes public. In most cases, some pre-allocation of tokens occurs before the project is publicly released, so it is essentially unavoidable. However, as a general rule, the more diversely a token is distributed at launch, the safer it is to invest in; if there are any whales, for example, there is a possibility that these wallets will sell all of their tokens at once and cause prices to drop substantially.

Supply - the supply of a token refers to its circulating supply, its total supply, and its maximum supply—in other words, the amount of usable tokens, the amount of both usable and unusable tokens, and the amount of tokens that can ever be minted. In the case of the maximum supply of tokens, some projects, especially those that operate under a proof-of-stake (PoS) consensus algorithm, have no maximum amount and can therefore be generated indefinitely. However, some tokens—such as Bitcoin, which has a maximum supply of 21 million—have a set amount that can ever exist, after which no new tokens can be generated. As with fiat currencies, if a large amount of tokens is being created at once, inflation may occur and resultingly lower that token's value.

Market capitalization (a.k.a. market cap) - refers to the total amount of investment in a cryptocurrency so far. Generally, the higher the market cap and the lower the total supply is for a particular cryptocurrency, the more valuable it is per coin or token. Additionally, the fully diluted market cap—the theoretical market cap if the maximum supply of a token is in circulation—can provide insight into the value of an individual token.

Token model - cryptocurrencies can either have inflationary or deflationary models—the former means that there is no maximum supply of that cryptocurrency, and the latter means that there is a maximum supply and that new coins or tokens will eventually stop being created. With the deflationary model, prices will increase over time as long as the demand for the cryptocurrency remains consistent. On the other hand, with the inflationary model, the opposite is true.

Of the 20K+ Decentralized Finance (DeFi) cryptocurrencies and tokens listed on CoinMarketCap.com, from a traditional Centralized Finance (CeFi) regulatory perspective (e.g., US Treasury, US SEC, US Federal Reserve) relatively few of them would qualify as traditional currencies. While the Group of Seven (G7) economic powers sort out the regulatory issues associated with classifying DeFi financial assets vs. CeFi financial assets, the following draft table indicates "work-in-progress"—there is yet no emerging consensus among the G7!

The following table compares and contrasts Cryptoeconomic DeFi financial assets vs macroeconomic CeFi financial assets:

Table: Financial Asset Types - DeFi vs CeFi

| Asset Type | Canonical Examples | CeFi Examples | DeFi Examples |

|---|---|---|---|

| Currency | National fiat currencies | USD, EUR, YEN, GPB, YUAN, ... | Stable Coins: USDT, USDC, BUSD, ...; CBDCs: digital Yuan (a.k,a., e-CNY, e-RMB, e-Yuan), digital "Loonie" (digital CAD), ... |

| Equity Security | Stocks (shares in corporations) | AAPL, GOOG, TSLA, AMZN, ... | All Altcoins not designated as Stable Coins, Commodities, NFTs. |

| Debt Security | Corporate & Government bonds | Corporate grade AAA-BBB & junk bonds / US Treasuries, EU-Bonds, ... | BTC Bonds [El Salvador] |

| Commodity | Precious metals / Agricultural goods / Fossil fuels / ... | Gold, Silver, Platinum, ... / Wheat, Corn, Soybeans, / Oil, Natural Gas, ... | BTC, ETH** [TBD], ... |

| Tangible Assets | Physical Property ... | Real Estate, Jewelry, Fine Art, ... | Non-Fungible Tokens (NFTs) for digital Art, ... |

| Intangible Assets | Intellectual Property ... | Patents, Copyrights, Trademarks ... | Non-Fungible Tokens (NFTs) for digital Copyrights, ... |

Bitcoin is often referred to as “digital gold” by its advocates, who maintain that bitcoin can provide a stable store-of-value, similar to gold, whose value is uncorrelated with more volatile financial assets, such as stocks. Bitcoin maximalists also see the cryptocurrency as a “safe haven” asset that can serve as a hedge against global economic uncertainty and inflation, which reduce the purchasing power of sovereign currencies (e.g., USD, EUR, GBP).

A Central Bank Digital Currency, or CBDC, is a form of digital currency that is issued by a central bank. The value of the CBDC is tethered to the country's fiat currency, so it is essentially the digital version of a country's fiat currency. CBDCs are centralized, unlike cryptocurrencies that run on a distributed ledger, meaning that they are issued by a Central Bank. However, because of this, the Central Bank would have the sole power to change the amount of money in any account at will; on the other hand, at least 51% of the users of a distributed ledger would need to be in agreement for this to occur with a decentralized currency.

Due to its centralization, however, CBDCs could be a more efficient and secure alternative to fiat currencies that can also more easily prevent illicit activity (due to the Central Bank's ability to keep track of the location of every unit of the CBDC, it would be more difficult to launder money or evade taxes, and it would be easier to detect criminal activity).

Cryptography is the study and practice of techniques for secure (confidential or private) communication in the presence of third parties, referred to as adversaries in this context, because the latter may intercept and compromise (usually by decoding or deciphering) the secure communication for nefarious purposes. In general practice, cryptography is concerned about designing and analyzing secure communication protocols that thwart adversaries.

For a more comprehensive explanation of cryptography see the source FAQ: What is cryptography and how does it work? on fhe CryptographyWorks.com web.

At the time of this writing cryptocurrencies are legal in the USA; however, they are undergoing massive investigations by various Federal Agencies regarding how they are regulated. The regulation of cryptocurrencies internationally varies by country and is outside the scope of this FAQ.

If you seek further information about this FAQ, please contact us.

Cryptocurrencies and cryptocurrency exchanges are legal in the USA and fall under the regulatory scope of the Bank Secrecy Act (BSA) and Anti-Money-Laundering (AML) laws. The Anti-Money Laundering Act of 2020 codifies prior Financial Crimes Enforcement Network (FinCEN) guidance by making all transactions in which “value that substitutes for currency” (including digital and other cryptocurrencies) subject to reporting FinCEN requirements and money transmitter registration.

Cryptocurrency regulations vary from state to state and are typically covered under existing money transmitter rules.

If you seek further information about this FAQ, please contact us.

The EU Markets in Crypto-Assets (MiCA) law is designed to provide a regulatory framework that protects consumers from the various risks associated with crypto-asset investment, covering unbacked crypto-assets and stablecoins, trading venues, and crypto wallets. MiCA also requires that the European Banking Authority (EBA) maintain a public register of crypto-asset service providers (CASPs) that do not comply with Anti-Money Laundering (AML) laws, which will serve as a cryptocurrency blacklist.

More specifically, not only are CASPs required to be authorized by national authorities, but they must also have a liquid reserve that protects holders from losses due to cybersecurity hacks or other preventable failures. Furthermore, MiCA covers insider trading and other forms of market abuse.

If you seek further information about this FAQ, please contact us.

Derived from the 1946 U.S. Supreme Court Case SEC vs. W. J. Howey, the Howey Test broadly determines whether a transaction should be considered a security, and therefore subject to USA security laws and regulations, depending on whether it qualifies as an "investment contract". In order to be considered an investment contract, a transaction must be: 1) an investment of money; 2) in a common enterprise; 3) with the expectation of profit; 4) to be derived from the effort of others.

In the context of cryptocurrencies, the SEC has suggested that the Howey Test should be used to determine whether a cryptocurrency qualifies as a security as opposed to a commodity, so that it can potentially regulate its sale and usage. It has been legally argued that Bitcoin (BTC) would fail the Howey Test because at its inception, there was no BTC common enterprise with an expectation of profit. Similary, it has been argued that Ethereum (ETH) would fail the Howey Test because at its inception Ethereum was an informal open-source project (cf. business enterprise) with no clear expectation of profit. In contrast, the vast majority of other cryptocurrencies will potentially pass the Howey Test, because most of their Initial Coin Offerings (ICOs; cf. IPOs) were issued by businesses enterprises that had a clear expectation of profit.

If you seek further information about this FAQ, please contact us.

Pros and Cons of Proof-of-Work include:

- PROS:

- Incentivized cryptocurrency rewards for miners

- Transaction validation is decentralized

- Generally secure

- CONS:

- Expensive equipment needed

- Energy-intensive

- Slow TPS and higher transaction fees than PoS

Pros and Cons of Proof-of-Stake include:

- PROS:

- Doesn't require expensive equipment

- Energy-efficient

- Faster TPS and lower transaction fees than Proof-of-Work

- CONS:

- Largest stakeholders have the most influence over the blockchain

- Incentivizes coin hoarding

- Requires extensive up-front investment in the cryptocurrency

DISCLAIMERS

NO INVESTMENT ADVICE

The information provided on this website does not constitute investment advice, financial advice, trading advice, legal advice, or any other sort of advice, and you should not treat any of the website's content as such. CRYPTOCURRENCY WORKS does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor or legal advisor before making any investment decisions.

ACCURACY OF INFORMATION

CRYPTOCURRENCY WORKS will strive to ensure the accuracy of information provided on this website, although it will not hold any responsibility for any missing or erroneous information. CRYPTOCURRENCY WORKS provides all information as is. You understand that you are using any and all information available here at your own risk.

CRYPTOCURRENCY WORKS and Cryptocurrencyworks.com are trademarks of PivotPoint Technology Corporation. All other product and service names mentioned are the trademarks of their respective companies.